Page 177 - Microsoft Word - 00 IWB ACCA F7.docx

P. 177

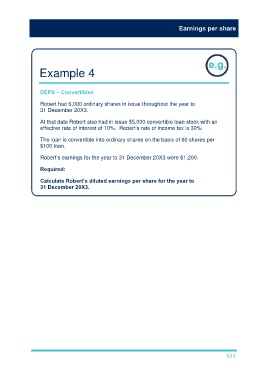

Earnings per share

Example 4

DEPS – Convertibles

Robert had 6,000 ordinary shares in issue throughout the year to

31 December 20X3.

At that date Robert also had in issue $5,000 convertible loan stock with an

effective rate of interest of 10%. Robert’s rate of income tax is 30%.

The loan is convertible into ordinary shares on the basis of 60 shares per

$100 loan.

Robert’s earnings for the year to 31 December 20X3 were $1,200.

Required:

Calculate Robert’s diluted earnings per share for the year to

31 December 20X3.

171