Page 202 - Microsoft Word - 00 IWB ACCA F7.docx

P. 202

Chapter 17

The difference between reserves at the reporting date and the

acquisition date (post-acquisition) is split between the group (W5) and

the non-controlling interest (W4).

Fair value and PURP adjustments are explained later in the chapter.

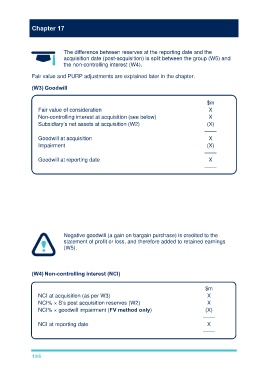

(W3) Goodwill

$m

Fair value of consideration X

Non-controlling interest at acquisition (see below) X

Subsidiary’s net assets at acquisition (W2) (X)

––––

Goodwill at acquisition X

Impairment (X)

––––

Goodwill at reporting date X

––––

The non-controlling interest at acquisition can either

be measured at:

fair value (either given in question or sufficient detail to calculate)

its proportionate share of the fair value of the subsidiary’s net assets at the

acquisition date.

Negative goodwill (a gain on bargain purchase) is credited to the

statement of profit or loss, and therefore added to retained earnings

(W5).

(W4) Non-controlling interest (NCI)

$m

NCI at acquisition (as per W3) X

NCI% × S’s post acquisition reserves (W2) X

NCI% × goodwill impairment (FV method only) (X)

––––

NCI at reporting date X

––––

196