Page 220 - Microsoft Word - 00 IWB ACCA F7.docx

P. 220

Chapter 18

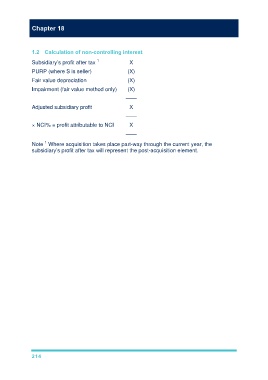

1.2 Calculation of non-controlling interest

Subsidiary’s profit after tax 1 X

PURP (where S is seller) (X)

Fair value depreciation (X)

Impairment (fair value method only) (X)

——

Adjusted subsidiary profit X

——

× NCI% = profit attributable to NCI X

——

1

Note Where acquisition takes place part-way through the current year, the

subsidiary’s profit after tax will represent the post-acquisition element.

214