Page 240 - Microsoft Word - 00 IWB ACCA F7.docx

P. 240

Chapter 19

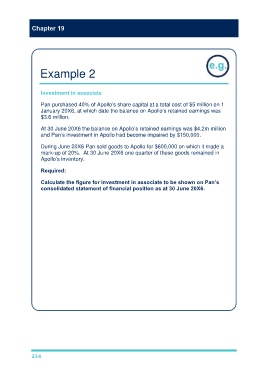

Example 2

Investment in associate

Pan purchased 40% of Apollo’s share capital at a total cost of $5 million on 1

January 20X6, at which date the balance on Apollo’s retained earnings was

$3.6 million.

At 30 June 20X6 the balance on Apollo’s retained earnings was $4.2m million

and Pan’s investment in Apollo had become impaired by $150,000.

During June 20X6 Pan sold goods to Apollo for $600,000 on which it made a

mark-up of 20%. At 30 June 20X6 one quarter of these goods remained in

Apollo’s inventory.

Required:

Calculate the figure for investment in associate to be shown on Pan’s

consolidated statement of financial position as at 30 June 20X6.

Solution:

$000

Cost of investment 5,000

1

Pan’s share of Apollo post-acquisition reserves 240

($4.2m – $3.6m) × 40%

Impairment as above (150) 1

PURP adjustment (10) 1

20

($600,000 × / 120 × ¼ × 40%)

———

Investment in associate 5,080

———

1

Note that the other side of the entry is to group retained earnings (W5).

234