Page 291 - Microsoft Word - 00 IWB ACCA F7.docx

P. 291

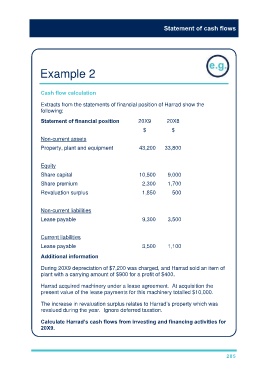

Statement of cash flows

Example 2

Cash flow calculation

Extracts from the statements of financial position of Harrad show the

following:

Statement of financial position 20X9 20X8

$ $

Non-current assets

Property, plant and equipment 43,200 33,800

Equity

Share capital 10,500 9,000

Share premium 2,300 1,700

Revaluation surplus 1,850 500

Non-current liabilities

Lease payable 9,300 3,500

Current liabilities

Lease payable 3,500 1,100

Additional information

During 20X9 depreciation of $7,200 was charged, and Harrad sold an item of

plant with a carrying amount of $900 for a profit of $400.

Harrad acquired machinery under a lease agreement. At acquisition the

present value of the lease payments for this machinery totalled $10,000.

The increase in revaluation surplus relates to Harrad’s property which was

revalued during the year. Ignore deferred taxation.

Calculate Harrad’s cash flows from investing and financing activities for

20X9.

285