Page 312 - Microsoft Word - 00 IWB ACCA F7.docx

P. 312

Chapter 24

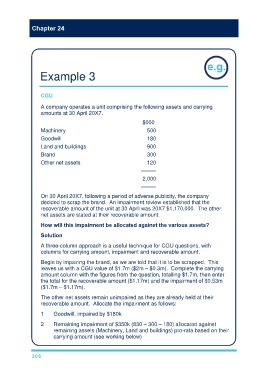

Example 3

CGU

A company operates a unit comprising the following assets and carrying

amounts at 30 April 20X7.

$000

Machinery 500

Goodwill 180

Land and buildings 900

Brand 300

Other net assets 120

–––––

2,000

–––––

On 30 April 20X7, following a period of adverse publicity, the company

decided to scrap the brand. An impairment review established that the

recoverable amount of the unit at 30 April was 20X7 $1,170,000. The other

net assets are stated at their recoverable amount.

How will this impairment be allocated against the various assets?

Solution

A three-column approach is a useful technique for CGU questions, with

columns for carrying amount, impairment and recoverable amount.

Begin by impairing the brand, as we are told that it is to be scrapped. This

leaves us with a CGU value of $1.7m ($2m – $0.3m). Complete the carrying

amount column with the figures from the question, totalling $1.7m, then enter

the total for the recoverable amount ($1.17m) and the impairment of $0.53m

($1.7m – $1.17m).

The other net assets remain unimpaired as they are already held at their

recoverable amount. Allocate the impairment as follows:

1 Goodwill, impaired by $180k

2 Remaining impairment of $350k (830 – 300 – 180) allocated against

remaining assets (Machinery, Land and buildings) pro-rata based on their

carrying amount (see working below)

306