Page 27 - PowerPoint Presentation

P. 27

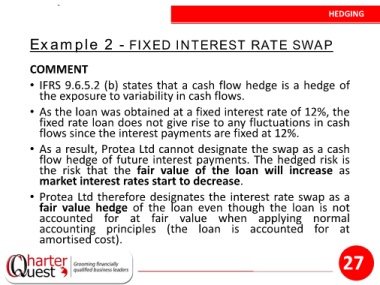

HEDGING

Example 2 - FIXED INTEREST RATE SWAP

COMMENT

• IFRS 9.6.5.2 (b) states that a cash flow hedge is a hedge of

the exposure to variability in cash flows.

• As the loan was obtained at a fixed interest rate of 12%, the

fixed rate loan does not give rise to any fluctuations in cash

flows since the interest payments are fixed at 12%.

• As a result, Protea Ltd cannot designate the swap as a cash

flow hedge of future interest payments. The hedged risk is

the risk that the fair value of the loan will increase as

market interest rates start to decrease.

• Protea Ltd therefore designates the interest rate swap as a

fair value hedge of the loan even though the loan is not

accounted for at fair value when applying normal

accounting principles (the loan is accounted for at

amortised cost).

27