Page 119 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 119

Discounting and investment appraisal

Discounting annuities and perpetuities

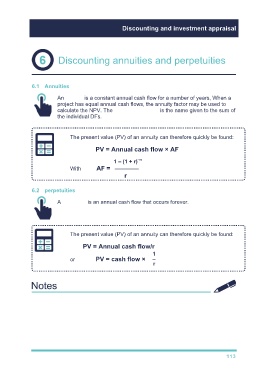

6.1 Annuities

An annuity is a constant annual cash flow for a number of years, When a

project has equal annual cash flows, the annuity factor may be used to

calculate the NPV. The annuity factor (AF) is the name given to the sum of

the individual DFs.

The present value (PV) of an annuity can therefore quickly be found:

PV = Annual cash flow × AF

–n

1 – (1 + r)

With AF = ––––––––

r

6.2 perpetuities

A perpetuity is an annual cash flow that occurs forever.

The present value (PV) of an annuity can therefore quickly be found:

PV = Annual cash flow/r

1

or PV = cash flow × –

r

113