Page 193 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 193

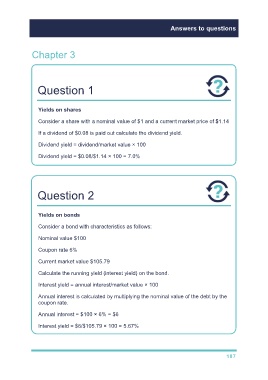

Answers to questions

Chapter 3

Question 1

Yields on shares

Consider a share with a nominal value of $1 and a current market price of $1.14

If a dividend of $0.08 is paid out calculate the dividend yield.

Dividend yield = dividend/market value × 100

Dividend yield = $0.08/$1.14 × 100 = 7.0%

Question 2

Yields on bonds

Consider a bond with characteristics as follows:

Nominal value $100

Coupon rate 6%

Current market value $105.79

Calculate the running yield (interest yield) on the bond.

Interest yield = annual interest/market value × 100

Annual interest is calculated by multiplying the nominal value of the debt by the

coupon rate.

Annual interest = $100 × 6% = $6

Interest yield = $6/$105.79 × 100 = 5.67%

187