Page 119 - 5.2 i. Manac Finance ITC Summarised Notes

P. 119

CAPITAL INVESTMENT APPRAISAL

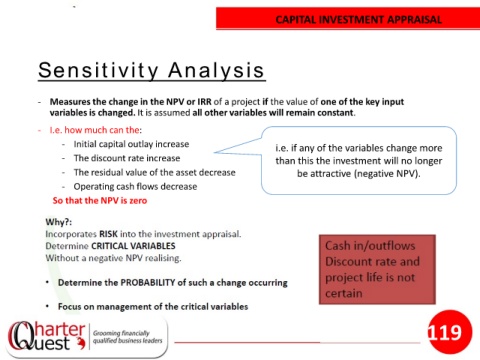

Sensitivity Analysis

- Measures the change in the NPV or IRR of a project if the value of one of the key input

variables is changed. It is assumed all other variables will remain constant.

- I.e. how much can the:

- Initial capital outlay increase i.e. if any of the variables change more

- The discount rate increase than this the investment will no longer

- The residual value of the asset decrease be attractive (negative NPV).

- Operating cash flows decrease

So that the NPV is zero

119