Page 163 - FR Integrated Workbook 2018-19

P. 163

Revenue

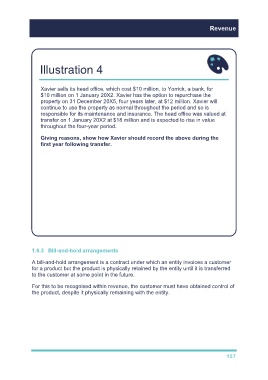

Illustration 4

Xavier sells its head office, which cost $10 million, to Yorrick, a bank, for

$10 million on 1 January 20X2. Xavier has the option to repurchase the

property on 31 December 20X5, four years later, at $12 million. Xavier will

continue to use the property as normal throughout the period and so is

responsible for its maintenance and insurance. The head office was valued at

transfer on 1 January 20X2 at $18 million and is expected to rise in value

throughout the four-year period.

Giving reasons, show how Xavier should record the above during the

first year following transfer.

Solution

Yorrick bears the risk of falling property prices.

Xavier continues to insure and maintain the property.

Xavier will benefit from a rising property price.

Xavier has the benefit of use of the property.

Xavier should continue to recognise the head office as an asset in the

statement of financial position. This is a secured loan with effective interest of

$2 million ($12 million – $10 million) over the four-year period.

1.6.3 Bill-and-hold arrangements

A bill-and-hold arrangement is a contract under which an entity invoices a customer

for a product but the product is physically retained by the entity until it is transferred

to the customer at some point in the future.

For this to be recognised within revenue, the customer must have obtained control of

the product, despite it physically remaining with the entity.

157