Page 183 - FR Integrated Workbook 2018-19

P. 183

Taxation

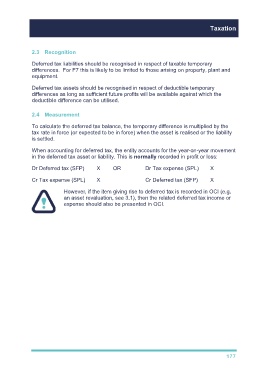

2.3 Recognition

Deferred tax liabilities should be recognised in respect of taxable temporary

differences. For F7 this is likely to be limited to those arising on property, plant and

equipment.

Deferred tax assets should be recognised in respect of deductible temporary

differences as long as sufficient future profits will be available against which the

deductible difference can be utilised.

2.4 Measurement

To calculate the deferred tax balance, the temporary difference is multiplied by the

tax rate in force (or expected to be in force) when the asset is realised or the liability

is settled.

When accounting for deferred tax, the entity accounts for the year-on-year movement

in the deferred tax asset or liability. This is normally recorded in profit or loss:

Dr Deferred tax (SFP) X OR Dr Tax expense (SPL) X

Cr Tax expense (SPL) X Cr Deferred tax (SFP) X

However, if the item giving rise to deferred tax is recorded in OCI (e.g.

an asset revaluation, see 3.1), then the related deferred tax income or

expense should also be presented in OCI.

177