Page 398 - FR Integrated Workbook 2018-19

P. 398

Chapter 24

Chapter 18

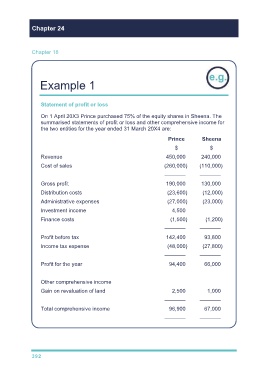

Example 1

Statement of profit or loss

On 1 April 20X3 Prince purchased 75% of the equity shares in Sheena. The

summarised statements of profit or loss and other comprehensive income for

the two entities for the year ended 31 March 20X4 are:

Prince Sheena

$ $

Revenue 450,000 240,000

Cost of sales (260,000) (110,000)

––––––– –––––––

Gross profit 190,000 130,000

Distribution costs (23,600) (12,000)

Administrative expenses (27,000) (23,000)

Investment income 4,500

Finance costs (1,500) (1,200)

––––––– –––––––

Profit before tax 142,400 93,800

Income tax expense (48,000) (27,800)

––––––– –––––––

Profit for the year 94,400 66,000

Other comprehensive income

Gain on revaluation of land 2,500 1,000

––––––– –––––––

Total comprehensive income 96,900 67,000

––––––– –––––––

392