Page 118 - ADVANCED TAXATION - Day 1 Slides

P. 118

118

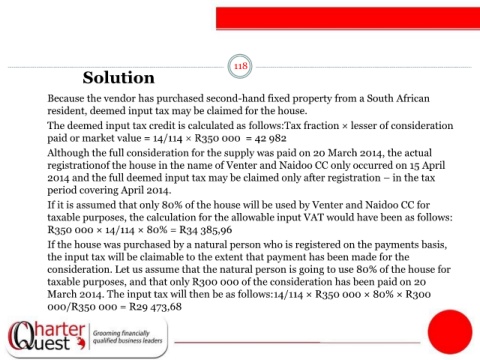

Solution

Because the vendor has purchased second-hand fixed property from a South African

resident, deemed input tax may be claimed for the house.

The deemed input tax credit is calculated as follows:Tax fraction × lesser of consideration

paid or market value = 14/114 × R350 000 = 42 982

Although the full consideration for the supply was paid on 20 March 2014, the actual

registrationof the house in the name of Venter and Naidoo CC only occurred on 15 April

2014 and the full deemed input tax may be claimed only after registration – in the tax

period covering April 2014.

If it is assumed that only 80% of the house will be used by Venter and Naidoo CC for

taxable purposes, the calculation for the allowable input VAT would have been as follows:

R350 000 × 14/114 × 80% = R34 385,96

If the house was purchased by a natural person who is registered on the payments basis,

the input tax will be claimable to the extent that payment has been made for the

consideration. Let us assume that the natural person is going to use 80% of the house for

taxable purposes, and that only R300 000 of the consideration has been paid on 20

March 2014. The input tax will then be as follows:14/114 × R350 000 × 80% × R300

000/R350 000 = R29 473,68