Page 31 - ADVANCED TAXATION - Day 1 Slides

P. 31

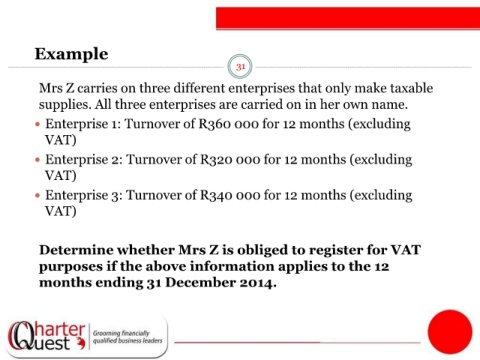

Example

31

Mrs Z carries on three different enterprises that only make taxable

supplies. All three enterprises are carried on in her own name.

Enterprise 1: Turnover of R360 000 for 12 months (excluding

VAT)

Enterprise 2: Turnover of R320 000 for 12 months (excluding

VAT)

Enterprise 3: Turnover of R340 000 for 12 months (excluding

VAT)

Determine whether Mrs Z is obliged to register for VAT

purposes if the above information applies to the 12

months ending 31 December 2014.