Page 20 - PowerPoint Presentation

P. 20

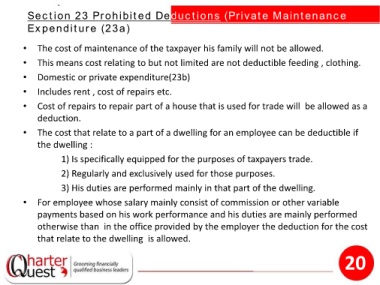

Section 23 Prohibited Deductions (Private Maintenance

Expenditure (23a)

• The cost of maintenance of the taxpayer his family will not be allowed.

• This means cost relating to but not limited are not deductible feeding , clothing.

• Domestic or private expenditure(23b)

• Includes rent , cost of repairs etc.

• Cost of repairs to repair part of a house that is used for trade will be allowed as a

deduction.

• The cost that relate to a part of a dwelling for an employee can be deductible if

the dwelling :

1) Is specifically equipped for the purposes of taxpayers trade.

2) Regularly and exclusively used for those purposes.

3) His duties are performed mainly in that part of the dwelling.

• For employee whose salary mainly consist of commission or other variable

payments based on his work performance and his duties are mainly performed

otherwise than in the office provided by the employer the deduction for the cost

that relate to the dwelling is allowed.

20