Page 19 - F6 Slide - VAT Part 4 - Lecture Day 5

P. 19

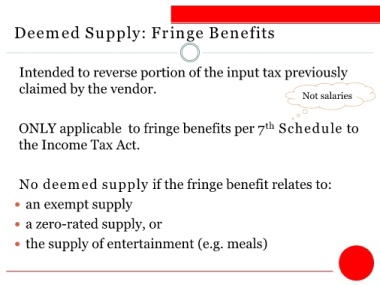

Deemed Supply: Fringe Benefits

Intended to reverse portion of the input tax previously

claimed by the vendor.

Not salaries

ONLY applicable to fringe benefits per 7 Schedule to

th

the Income Tax Act.

No deemed supply if the fringe benefit relates to:

an exempt supply

a zero-rated supply, or

the supply of entertainment (e.g. meals)