Page 9 - CHAPTER 1 - INTRODUCTION AND INTERPRETATION

P. 9

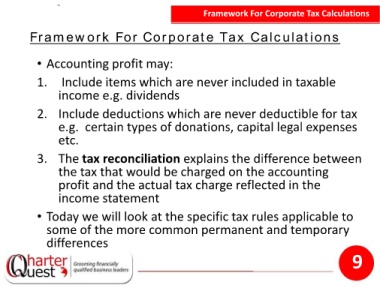

Framework For Corporate Tax Calculations

Framework For Corporate Tax Calculations

• Accounting profit may:

1. Include items which are never included in taxable

income e.g. dividends

2. Include deductions which are never deductible for tax

e.g. certain types of donations, capital legal expenses

etc.

3. The tax reconciliation explains the difference between

the tax that would be charged on the accounting

profit and the actual tax charge reflected in the

income statement

• Today we will look at the specific tax rules applicable to

some of the more common permanent and temporary

differences

9