Page 8 - PowerPoint Presentation

P. 8

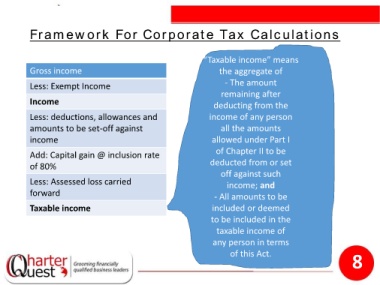

Framework For Corporate Tax Calculations

“Taxable income” means

Gross income the aggregate of

Less: Exempt Income - The amount

remaining after

Income deducting from the

Less: deductions, allowances and income of any person

amounts to be set-off against all the amounts

income allowed under Part I

Add: Capital gain @ inclusion rate of Chapter II to be

of 80% deducted from or set

off against such

Less: Assessed loss carried income; and

forward - All amounts to be

Taxable income included or deemed

to be included in the

taxable income of

any person in terms

8

of this Act.