Page 209 - F1 - AB Integrated Workbook STUDENT 2018-19

P. 209

Accounting and finance functions within business

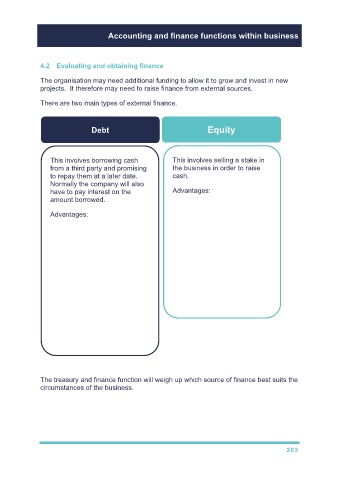

4.2 Evaluating and obtaining finance

The organisation may need additional funding to allow it to grow and invest in new

projects. It therefore may need to raise finance from external sources.

There are two main types of external finance.

Debt Equity

This involves borrowing cash This involves selling a stake in

from a third party and promising the business in order to raise

to repay them at a later date. cash.

Normally the company will also

have to pay interest on the Advantages:

amount borrowed.

no minimum level of

Advantages: dividend that must be paid

to shareholders. Interest

interest payments payments on debt finance

allowable against tax must be paid each year

does not change a bank will normally require

ownership of the security on the company’s

organisation assets before it will offer a

loan. Some companies

tends to be cheaper to may lack quality assets to

service than equity as it is offer, making equity more

often secured against attractive as it does not

assets of the company and require security.

take priority over equity in

the event of the business

being liquidated.

Job security

The treasury and finance function will weigh up which source of finance best suits the

circumstances of the business.

203