Page 169 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 169

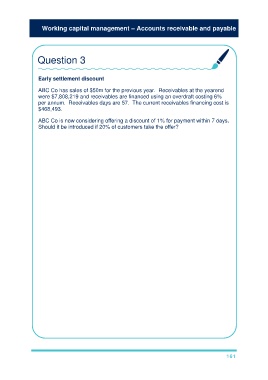

Working capital management – Accounts receivable and payable

Question 3

Early settlement discount

ABC Co has sales of $50m for the previous year. Receivables at the yearend

were $7,808,219 and receivables are financed using an overdraft costing 6%

per annum. Receivables days are 57. The current receivables financing cost is

$468,493.

ABC Co is now considering offering a discount of 1% for payment within 7 days.

Should it be introduced if 20% of customers take the offer?

Sales on which discount is applied = $50m × 20% = $10,000,000.

Old receivables balance on these sales: $10m × 57/365 = $1,561,644

Financing cost on these receivables: $1,561,644 × 6% = $93,699

New receivables balance for these sales: $10m × 7/365 = $191,781

Financing cost on these receivables: $191,781 × 6% = $11,507

Financing cost saving for these receivables = $93,699 – $11,507 = $82,192

Cost of discount = $10m × 1% = $100,000

The cost of the discount is greater than the benefit from the saving in the

finance cost and so the discount should not be offered.

Alternative calculation for finance cost saving:

New receivables total balance = $191,781 + $50m × 80% × 57/365 =

$6,438,356

New total financing cost = $6,438,356 × 6% = $386,301

Finance cost saving = $468,493 – $386,301 = $82,192

161