Page 262 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 262

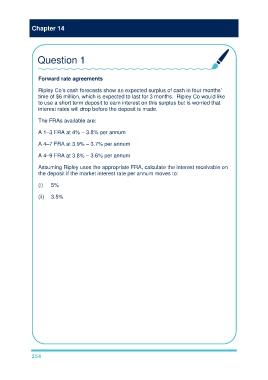

Chapter 14

Question 1

Forward rate agreements

Ripley Co’s cash forecasts show an expected surplus of cash in four months’

time of $6 million, which is expected to last for 3 months. Ripley Co would like

to use a short term deposit to earn interest on this surplus but is worried that

interest rates will drop before the deposit is made.

The FRAs available are:

A 1–3 FRA at 4% – 3.8% per annum

A 4–7 FRA at 3.9% – 3.7% per annum

A 4–9 FRA at 3.8% – 3.6% per annum

Assuming Ripley uses the appropriate FRA, calculate the interest receivable on

the deposit if the market interest rate per annum moves to:

(i) 5%

(ii) 3.5%

Deposit necessity starts in 4 months and ands in 7: 4–7 FRA needed. Deposit

rate is the lower of the spread so the rate will be effectively fixed at 3.7%

(i) Interest received on underlying deposit: $6m × 5% × 3/12 = $75,000

As the interest rate is higher than the FRA rate, Ripley Co must pay the

difference over to the FRA bank: $6m × (5% – 3.7%) × 3/12 = $19,500.

Net interest received = $75,000 – $19,500 = $55,500

(ii) Interest received on underlying deposit: $6m × 3.5% × 3/12 = $52,500

As the interest rate is lower than the FRA rate, the FRA bank will pay the

difference to Ripley Co: $6m × (3.7% – 3.5%) × 3/12 = $3,000

Total interest received = $52,500 + $3,000 = $55,500.

Either way the net position is a receipt at 3.7% ($6m × 3.7% × 3/12 =

$55,500)

254