Page 435 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 435

Business valuations and market efficiency

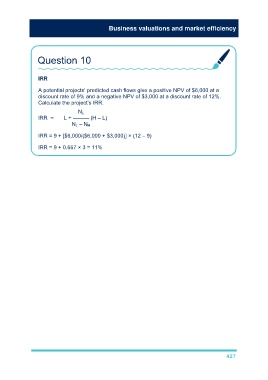

Question 10

IRR

A potential projects’ predicted cash flows give a positive NPV of $6,000 at a

discount rate of 9% and a negative NPV of $3,000 at a discount rate of 12%.

Calculate the project’s IRR.

N L

IRR = L + ——— (H – L)

N L – N H

IRR = 9 + [$6,000/($6,000 + $3,000)] × (12 – 9)

IRR = 9 + 0.667 × 3 = 11%

427