Page 494 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 494

Chapter 20

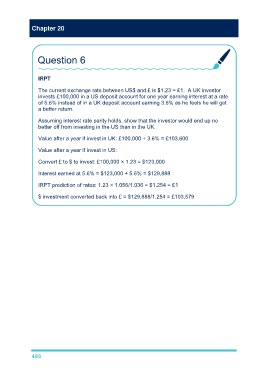

Question 6

IRPT

The current exchange rate between US$ and £ is $1.23 = £1. A UK investor

invests £100,000 in a US deposit account for one year earning interest at a rate

of 5.6% instead of in a UK deposit account earning 3.6% as he feels he will get

a better return.

Assuming interest rate parity holds, show that the investor would end up no

better off from investing in the US than in the UK.

Value after a year if invest in UK: £100,000 + 3.6% = £103,600

Value after a year if invest in US:

Convert £ to $ to invest: £100,000 × 1.23 = $123,000

Interest earned at 5.6% = $123,000 + 5.6% = $129,888

IRPT prediction of rates: 1.23 × 1.056/1.036 = $1.254 = £1

$ investment converted back into £ = $129,888/1.254 = £103,579

486