Page 54 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 54

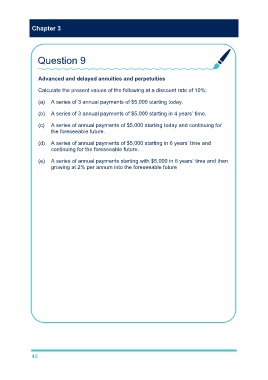

Chapter 3

Question 9

Advanced and delayed annuities and perpetuities

Calculate the present values of the following at a discount rate of 10%:

(a) A series of 3 annual payments of $5,000 starting today.

(b) A series of 3 annual payments of $5,000 starting in 4 years’ time.

(c) A series of annual payments of $5,000 starting today and continuing for

the foreseeable future.

(d) A series of annual payments of $5,000 starting in 6 years’ time and

continuing for the foreseeable future.

(e) A series of annual payments starting with $5,000 in 6 years’ time and then

growing at 2% per annum into the foreseeable future

(a) use annuity factor for 2 years and add 1 to its value

$5,000 × (1 + 1.736) = $13,680

(b) use 3 year annuity factor to discount to a single sum as at t3, then use

3 year discount factor to discount the single sum back to t0.

$5,000 × 2.487 × 0.751 = $$9,339

(c) use perpetuity factor and add 1 to its value

$5,000 × (1 + 1/0.1) = $55.000

(d) Use perpetuity factor to discount to a single sum as at t5, then use the

5 year discount factor to discount the single sum back to t0

$5,000 × 1/0.1 × 0.621 = $31,050

(e) Use growing perpetuity factor to discount to a single sum as at t5, then use

the 5 year discount factor to discount the single sum back to t0.

$5,000 × 1/(0.1 – 0.02) × 0.621 = $38,813

46