Page 544 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 544

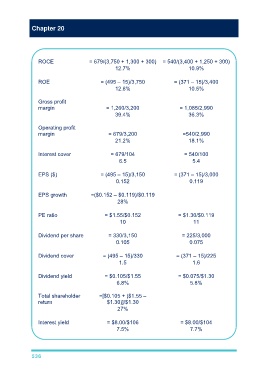

Chapter 20

ROCE = 679/(3,750 + 1,300 + 300) = 540/(3,400 + 1,250 + 300)

12.7% 10.9%

ROE = (495 – 15)/3,750 = (371 – 15)/3,400

12.8% 10.5%

Gross profit

margin = 1,260/3,200 = 1,085/2,990

39.4% 36.3%

Operating profit

margin = 679/3,200 =540/2,990

21.2% 18.1%

Interest cover = 679/104 = 540/100

6.5 5.4

EPS ($) = (495 – 15)/3,150 = (371 – 15)/3,000

0.152 0.119

EPS growth =($0.152 – $0.119)/$0.119

28%

PE ratio = $1.55/$0.152 = $1.30/$0.119

10 11

Dividend per share = 330/3,150 = 225/3,000

0.105 0.075

Dividend cover = (495 – 15)/330 = (371 – 15)/225

1.5 1.6

Dividend yield = $0.105/$1.55 = $0.075/$1.30

6.8% 5.8%

Total shareholder =[$0.105 + ($1.55 –

return $1.30)]/$1.30

27%

Interest yield = $8.00/$106 = $8.00/$104

7.5% 7.7%

536