Page 556 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 556

Chapter 20

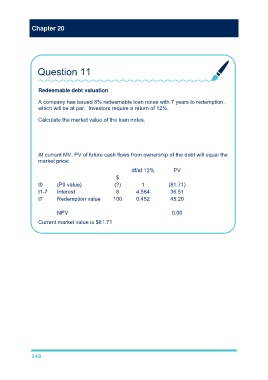

Question 11

Redeemable debt valuation

A company has issued 8% redeemable loan notes with 7 years to redemption,

which will be at par. Investors require a return of 12%.

Calculate the market value of the loan notes.

At current MV, PV of future cash flows from ownership of the debt will equal the

market price:

df/af 12% PV

$

t0 (P0 value) (?) 1 (81.71)

t1-7 Interest 8 4.564 36.51

t7 Redemption value 100 0.452 45.20

NPV 0.00

Current market value is $81.71

548