Page 37 - CFA - Day 1 & 2 Course Notes

P. 37

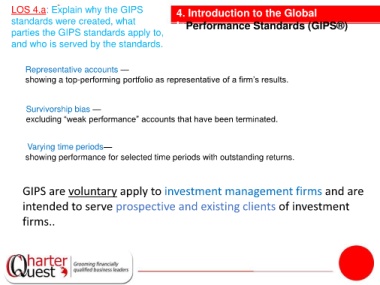

LOS 4.a: Explain why the GIPS 4. Introduction to the Global

standards were created, what InPerformance Standards (GIPS®)

parties the GIPS standards apply to,

and who is served by the standards.

Representative accounts —

showing a top-performing portfolio as representative of a firm’s results.

Survivorship bias —

excluding “weak performance” accounts that have been terminated.

Varying time periods—

showing performance for selected time periods with outstanding returns.

GIPS are voluntary apply to investment management firms and are

intended to serve prospective and existing clients of investment

firms..