Page 55 - CFA - Day 1 & 2 Course Notes

P. 55

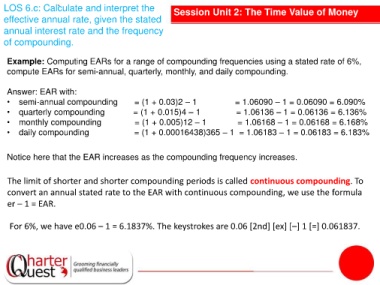

LOS 6.c: Calculate and interpret the Session Unit 2: The Time Value of Money

effective annual rate, given the stated

annual interest rate and the frequency

of compounding.

Example: Computing EARs for a range of compounding frequencies using a stated rate of 6%,

compute EARs for semi-annual, quarterly, monthly, and daily compounding.

Answer: EAR with:

• semi-annual compounding = (1 + 0.03)2 – 1 = 1.06090 – 1 = 0.06090 = 6.090%

• quarterly compounding = (1 + 0.015)4 – 1 = 1.06136 – 1 = 0.06136 = 6.136%

• monthly compounding = (1 + 0.005)12 – 1 = 1.06168 – 1 = 0.06168 = 6.168%

• daily compounding = (1 + 0.00016438)365 – 1 = 1.06183 – 1 = 0.06183 = 6.183%

Notice here that the EAR increases as the compounding frequency increases.

The limit of shorter and shorter compounding periods is called continuous compounding. To

convert an annual stated rate to the EAR with continuous compounding, we use the formula

er – 1 = EAR.

For 6%, we have e0.06 – 1 = 6.1837%. The keystrokes are 0.06 [2nd] [ex] [–] 1 [=] 0.061837.