Page 194 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 194

Chapter 9

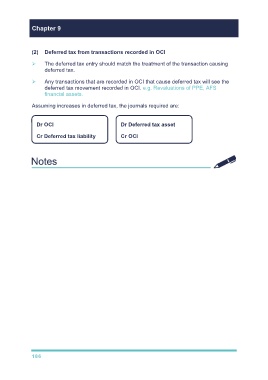

(2) Deferred tax from transactions recorded in OCI

The deferred tax entry should match the treatment of the transaction causing

deferred tax.

Any transactions that are recorded in OCI that cause deferred tax will see the

deferred tax movement recorded in OCI. e.g. Revaluations of PPE, AFS

financial assets.

Assuming increases in deferred tax, the journals required are:

Dr OCI Dr Deferred tax asset

Cr Deferred tax liability Cr OCI

186