Page 23 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 23

Cost of capital

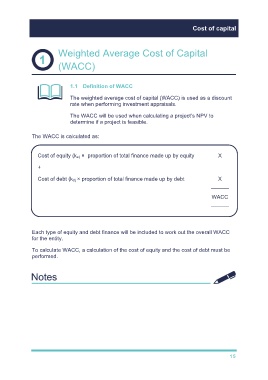

Weighted Average Cost of Capital

(WACC)

1.1 Definition of WACC

The weighted average cost of capital (WACC) is used as a discount

rate when performing investment appraisals.

The WACC will be used when calculating a project’s NPV to

determine if a project is feasible.

The WACC is calculated as:

Cost of equity (k e) × proportion of total finance made up by equity X

+

Cost of debt (k d) × proportion of total finance made up by debt X

––––––

WACC

––––––

Each type of equity and debt finance will be included to work out the overall WACC

for the entity.

To calculate WACC, a calculation of the cost of equity and the cost of debt must be

performed.

15