Page 302 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 302

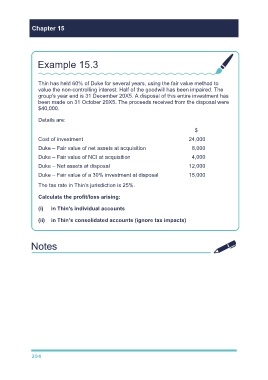

Chapter 15

Example 15.3

Thin has held 60% of Duke for several years, using the fair value method to

value the non-controlling interest. Half of the goodwill has been impaired. The

group's year end is 31 December 20X5. A disposal of this entire investment has

been made on 31 October 20X5. The proceeds received from the disposal were

$40,000.

Details are:

$

Cost of investment 24,000

Duke – Fair value of net assets at acquisition 8,000

Duke – Fair value of NCI at acquisition 4,000

Duke – Net assets at disposal 12,000

Duke – Fair value of a 30% investment at disposal 15,000

The tax rate in Thin’s jurisdiction is 25%.

Calculate the profit/loss arising:

(i) in Thin's individual accounts

(ii) in Thin’s consolidated accounts (ignore tax impacts)

294