Page 384 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 384

Chapter 20

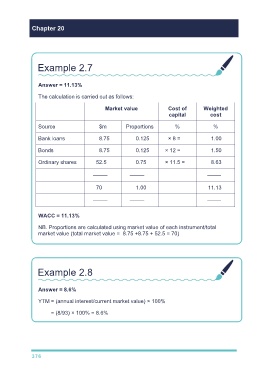

Example 2.7

Answer = 11.13%

The calculation is carried out as follows:

Market value Cost of Weighted

capital cost

Source $m Proportions % %

Bank loans 8.75 0.125 × 8 = 1.00

Bonds 8.75 0.125 × 12 = 1.50

Ordinary shares 52.5 0.75 × 11.5 = 8.63

—––– —––– ——–

70 1.00 11.13

—––– —––– ——–

WACC = 11.13%

NB. Proportions are calculated using market value of each instrument/total

market value (total market value = 8.75 +8.75 + 52.5 = 70)

Example 2.8

Answer = 8.6%

YTM = (annual interest/current market value) × 100%

= (8/93) × 100% = 8.6%

376