Page 391 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 391

Answers

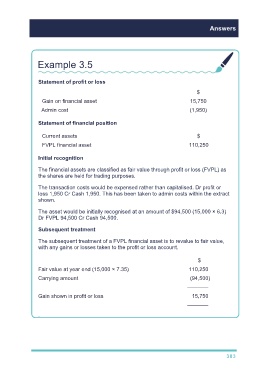

Example 3.5

Statement of profit or loss

$

Gain on financial asset 15,750

Admin cost (1,950)

Statement of financial position

Current assets $

FVPL financial asset 110,250

Initial recognition

The financial assets are classified as fair value through profit or loss (FVPL) as

the shares are held for trading purposes.

The transaction costs would be expensed rather than capitalised. Dr profit or

loss 1,950 Cr Cash 1,950. This has been taken to admin costs within the extract

shown.

The asset would be initially recognised at an amount of $94,500 (15,000 × 6.3)

Dr FVPL 94,500 Cr Cash 94,500.

Subsequent treatment

The subsequent treatment of a FVPL financial asset is to revalue to fair value,

with any gains or losses taken to the profit or loss account.

$

Fair value at year end (15,000 × 7.35) 110,250

Carrying amount (94,500)

–––––––

Gain shown in profit or loss 15,750

–––––––

.

383