Page 20 - PowerPoint Presentation

P. 20

Share-based Payment

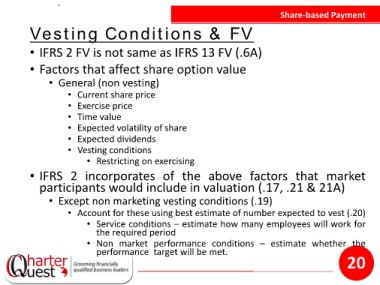

Vesting Conditions & FV

• IFRS 2 FV is not same as IFRS 13 FV (.6A)

• Factors that affect share option value

• General (non vesting)

• Current share price

• Exercise price

• Time value

• Expected volatility of share

• Expected dividends

• Vesting conditions

• Restricting on exercising

• IFRS 2 incorporates of the above factors that market

participants would include in valuation (.17, .21 & 21A)

• Except non marketing vesting conditions (.19)

• Account for these using best estimate of number expected to vest (.20)

• Service conditions – estimate how many employees will work for

the required period

• Non market performance conditions – estimate whether the

performance target will be met.

20