Page 27 - PowerPoint Presentation

P. 27

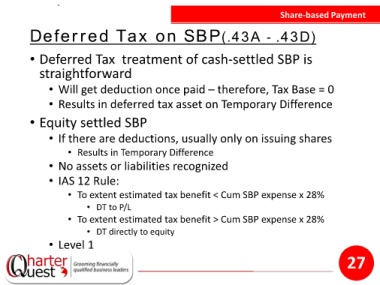

Share-based Payment

Deferred Tax on SBP(.43A ‐ .43D)

• Deferred Tax treatment of cash-settled SBP is

straightforward

• Will get deduction once paid – therefore, Tax Base = 0

• Results in deferred tax asset on Temporary Difference

• Equity settled SBP

• If there are deductions, usually only on issuing shares

• Results in Temporary Difference

• No assets or liabilities recognized

• IAS 12 Rule:

• To extent estimated tax benefit < Cum SBP expense x 28%

• DT to P/L

• To extent estimated tax benefit > Cum SBP expense x 28%

• DT directly to equity

• Level 1

27