Page 15 - Additional Notes on Employees Tax

P. 15

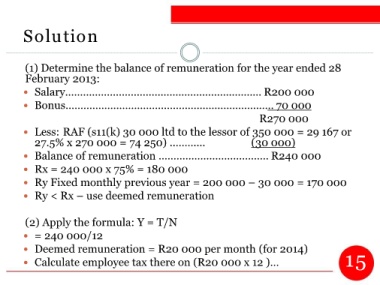

Solution

(1) Determine the balance of remuneration for the year ended 28

February 2013:

Salary.................................................................. R200 000

Bonus...................................................................... 70 000

R270 000

Less: RAF (s11(k) 30 000 ltd to the lessor of 350 000 = 29 167 or

27.5% x 270 000 = 74 250) ..…….... (30 000)

Balance of remuneration ..................................... R240 000

Rx = 240 000 x 75% = 180 000

Ry Fixed monthly previous year = 200 000 – 30 000 = 170 000

Ry < Rx – use deemed remuneration

(2) Apply the formula: Y = T/N

= 240 000/12

Deemed remuneration = R20 000 per month (for 2014)

Calculate employee tax there on (R20 000 x 12 )… 15