Page 20 - Finac1 Test 2 slides - 4. Share-based Payment (IFRS 2)

P. 20

SHARE-BASED PAYMENT

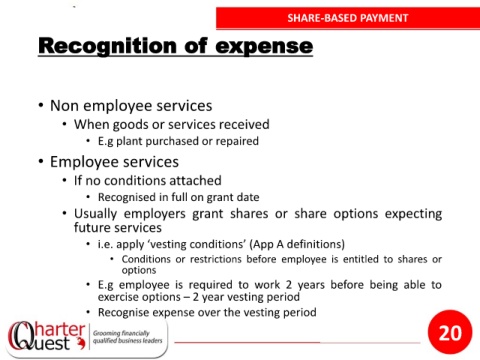

Recognition of expense

• Non employee services

• When goods or services received

• E.g plant purchased or repaired

• Employee services

• If no conditions attached

• Recognised in full on grant date

• Usually employers grant shares or share options expecting

future services

• i.e. apply ‘vesting conditions’ (App A definitions)

• Conditions or restrictions before employee is entitled to shares or

options

• E.g employee is required to work 2 years before being able to

exercise options – 2 year vesting period

• Recognise expense over the vesting period

20