Page 22 - F6 - Special Deductions

P. 22

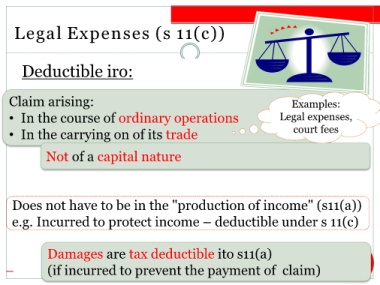

Legal Expenses (s 11(c))

Deductible iro:

Claim arising: Examples:

• In the course of ordinary operations Legal expenses,

• In the carrying on of its trade court fees

Not of a capital nature

Does not have to be in the "production of income" (s11(a))

e.g. Incurred to protect income – deductible under s 11(c)

Damages are tax deductible ito s11(a)

(if incurred to prevent the payment of claim)