Page 65 - Microsoft Word - 00 - Prelims.docx

P. 65

Returns, discounts and sales tax

3.3 Calculation of sales tax

Sales tax is charged at a variety of rates around the world. It is also subject to

different rates for different products within national boundaries. To reflect this ACCA

will examine you on a variety of rates – the rate will always be given to you in the

question.

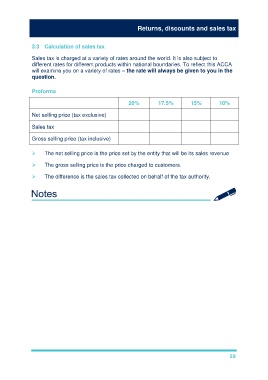

Proforma

20% 17.5% 15% 10%

Net selling price (tax exclusive) 100% 100% 100% 100%

Sales tax 20% 17.5% 15% 10%

Gross selling price (tax inclusive) 120% 117.5% 115% 110%

The net selling price is the price set by the entity that will be its sales revenue

The gross selling price is the price charged to customers.

The difference is the sales tax collected on behalf of the tax authority.

59