Page 74 - Microsoft Word - 00 - Prelims.docx

P. 74

Chapter 5

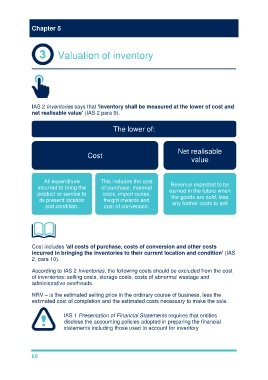

Valuation of inventory

IAS 2 Inventories says that ‘inventory shall be measured at the lower of cost and

net realisable value’ (IAS 2 para 9).

The lower of:

Net realisable

Cost

value

All expenditure This includes the cost

Revenue expected to be

incurred to bring the of purchase, material

product or service to costs, import duties, earned in the future when

its present location freight inwards and the goods are sold, less

and condition. cost of conversion. any further costs to sell

Cost includes 'all costs of purchase, costs of conversion and other costs

incurred in bringing the inventories to their current location and condition' (IAS

2, para 10).

According to IAS 2 Inventories, the following costs should be excluded from the cost

of inventories: selling costs, storage costs, costs of abnormal wastage and

administrative overheads.

NRV – is the estimated selling price in the ordinary course of business, less the

estimated cost of completion and the estimated costs necessary to make the sale.

IAS 1 Presentation of Financial Statements requires that entities

disclose the accounting policies adopted in preparing the financial

statements including those used to account for inventory

68