Page 399 - F3 Integrated Workbook STUDENT 2019

P. 399

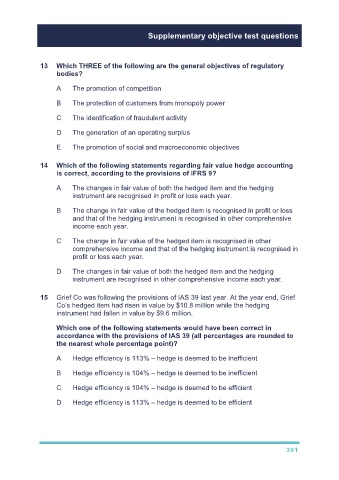

Supplementary objective test questions

13 Which THREE of the following are the general objectives of regulatory

bodies?

A The promotion of competition

B The protection of customers from monopoly power

C The identification of fraudulent activity

D The generation of an operating surplus

E The promotion of social and macroeconomic objectives

14 Which of the following statements regarding fair value hedge accounting

is correct, according to the provisions of IFRS 9?

A The changes in fair value of both the hedged item and the hedging

instrument are recognised in profit or loss each year.

B The change in fair value of the hedged item is recognised in profit or loss

and that of the hedging instrument is recognised in other comprehensive

income each year.

C The change in fair value of the hedged item is recognised in other

comprehensive income and that of the hedging instrument is recognised in

profit or loss each year.

D The changes in fair value of both the hedged item and the hedging

instrument are recognised in other comprehensive income each year.

15 Grief Co was following the provisions of IAS 39 last year. At the year end, Grief

Co’s hedged item had risen in value by $10.8 million while the hedging

instrument had fallen in value by $9.6 million.

Which one of the following statements would have been correct in

accordance with the provisions of IAS 39 (all percentages are rounded to

the nearest whole percentage point)?

A Hedge efficiency is 113% – hedge is deemed to be inefficient

B Hedge efficiency is 104% – hedge is deemed to be inefficient

C Hedge efficiency is 104% – hedge is deemed to be efficient

D Hedge efficiency is 113% – hedge is deemed to be efficient

391