Page 178 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 178

Chapter 8

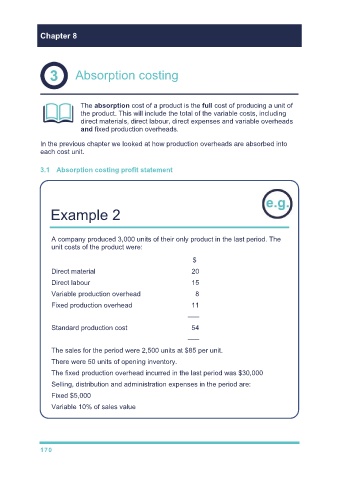

Absorption costing

The absorption cost of a product is the full cost of producing a unit of

the product. This will include the total of the variable costs, including

direct materials, direct labour, direct expenses and variable overheads

and fixed production overheads.

In the previous chapter we looked at how production overheads are absorbed into

each cost unit.

3.1 Absorption costing profit statement

Example 2

A company produced 3,000 units of their only product in the last period. The

unit costs of the product were:

$

Direct material 20

Direct labour 15

Variable production overhead 8

Fixed production overhead 11

–––

Standard production cost 54

–––

The sales for the period were 2,500 units at $85 per unit.

There were 50 units of opening inventory.

The fixed production overhead incurred in the last period was $30,000

Selling, distribution and administration expenses in the period are:

Fixed $5,000

Variable 10% of sales value

170