Page 311 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 311

Budgeting

6.3 Cash receipts and payments

To calculate the cash receipts from the credit sales there are two things to consider:

the value of the receipts – how much cash will be received from the credit sales

the timing of the receipts – when will the cash be received from the credit sales.

To calculate the cash payments for the credit purchases there are two things to

consider:

the value of the payment – how much cash will be paid to the payable

the timing of the payment – when will the cash be paid to the payable.

It may be necessary to calculate the amount due to be paid based on quantities

purchased.

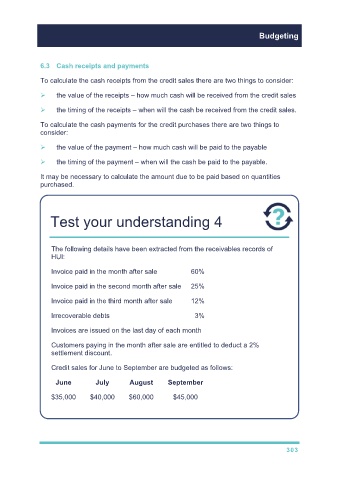

Test your understanding 4

The following details have been extracted from the receivables records of

HUI:

Invoice paid in the month after sale 60%

Invoice paid in the second month after sale 25%

Invoice paid in the third month after sale 12%

Irrecoverable debts 3%

Invoices are issued on the last day of each month

Customers paying in the month after sale are entitled to deduct a 2%

settlement discount.

Credit sales for June to September are budgeted as follows:

June July August September

$35,000 $40,000 $60,000 $45,000

303