Page 466 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 466

Chapter 18

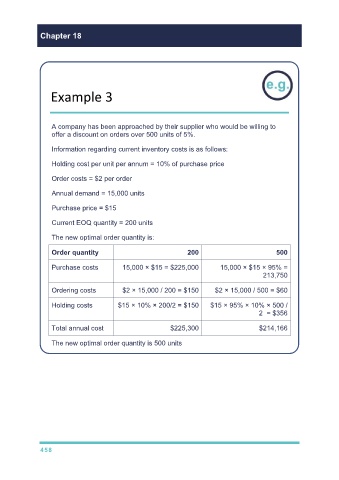

Example 3

A company has been approached by their supplier who would be willing to

offer a discount on orders over 500 units of 5%.

Information regarding current inventory costs is as follows:

Holding cost per unit per annum = 10% of purchase price

Order costs = $2 per order

Annual demand = 15,000 units

Purchase price = $15

Current EOQ quantity = 200 units

The new optimal order quantity is:

Order quantity 200 500

Purchase costs 15,000 × $15 = $225,000 15,000 × $15 × 95% =

213,750

Ordering costs $2 × 15,000 / 200 = $150 $2 × 15,000 / 500 = $60

Holding costs $15 × 10% × 200/2 = $150 $15 × 95% × 10% × 500 /

2 = $356

Total annual cost $225,300 $214,166

The new optimal order quantity is 500 units

458