Page 56 - P6 Slide Taxation - Lecture Day 6 - Dividend Tax

P. 56

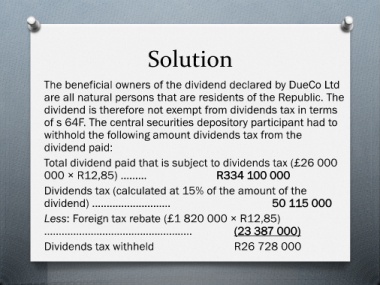

Solution

The beneficial owners of the dividend declared by DueCo Ltd

are all natural persons that are residents of the Republic. The

dividend is therefore not exempt from dividends tax in terms

of s 64F. The central securities depository participant had to

withhold the following amount dividends tax from the

dividend paid:

Total dividend paid that is subject to dividends tax (£26 000

000 × R12,85) ......... R334 100 000

Dividends tax (calculated at 15% of the amount of the

dividend) ........................... 50 115 000

Less: Foreign tax rebate (£1 820 000 × R12,85)

................................................... (23 387 000)

Dividends tax withheld R26 728 000