Page 21 - PowerPoint Presentation

P. 21

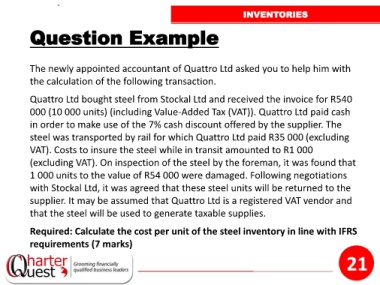

INVENTORIES

Question Example

The newly appointed accountant of Quattro Ltd asked you to help him with

the calculation of the following transaction.

Quattro Ltd bought steel from Stockal Ltd and received the invoice for R540

000 (10 000 units) (including Value-Added Tax (VAT)). Quattro Ltd paid cash

in order to make use of the 7% cash discount offered by the supplier. The

steel was transported by rail for which Quattro Ltd paid R35 000 (excluding

VAT). Costs to insure the steel while in transit amounted to R1 000

(excluding VAT). On inspection of the steel by the foreman, it was found that

1 000 units to the value of R54 000 were damaged. Following negotiations

with Stockal Ltd, it was agreed that these steel units will be returned to the

supplier. It may be assumed that Quattro Ltd is a registered VAT vendor and

that the steel will be used to generate taxable supplies.

Required: Calculate the cost per unit of the steel inventory in line with IFRS

requirements (7 marks)

21