Page 38 - FINAL CFA SLIDES DECEMBER 2018 DAY 3

P. 38

Session Unit 2:

9. Probability Concepts

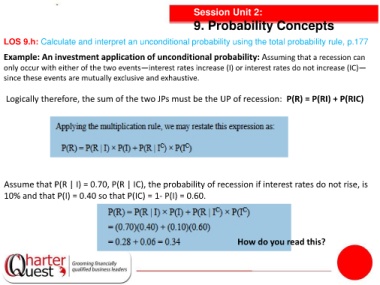

LOS 9.h: Calculate and interpret an unconditional probability using the total probability rule, p.177

Example: An investment application of unconditional probability: Assuming that a recession can

only occur with either of the two events—interest rates increase (I) or interest rates do not increase (IC)—

since these events are mutually exclusive and exhaustive.

Logically therefore, the sum of the two JPs must be the UP of recession: P(R) = P(RI) + P(RIC)

Assume that P(R | I) = 0.70, P(R | IC), the probability of recession if interest rates do not rise, is

10% and that P(I) = 0.40 so that P(IC) = 1- P(I) = 0.60.

How do you read this?