Page 9 - FINAL CFA SLIDES DECEMBER 2018 DAY 3

P. 9

Session Unit 2:

8. Statistical Concepts and Market Returns

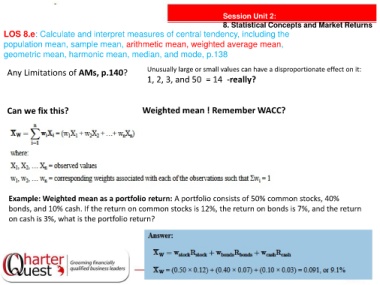

LOS 8.e: Calculate and interpret measures of central tendency, including the

population mean, sample mean, arithmetic mean, weighted average mean,

geometric mean, harmonic mean, median, and mode, p.138

Any Limitations of AMs, p.140? Unusually large or small values can have a disproportionate effect on it:

1, 2, 3, and 50 = 14 -really?

Can we fix this? Weighted mean ! Remember WACC?

Example: Weighted mean as a portfolio return: A portfolio consists of 50% common stocks, 40%

bonds, and 10% cash. If the return on common stocks is 12%, the return on bonds is 7%, and the return

on cash is 3%, what is the portfolio return?