Page 5 - Non-residence taxation

P. 5

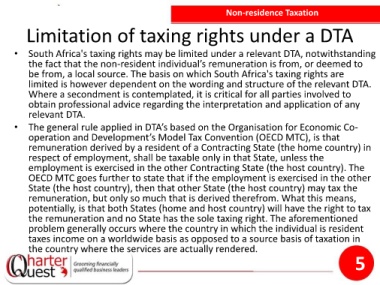

Non-residence Taxation

Limitation of taxing rights under a DTA

• South Africa's taxing rights may be limited under a relevant DTA, notwithstanding

the fact that the non-resident individual’s remuneration is from, or deemed to

be from, a local source. The basis on which South Africa's taxing rights are

limited is however dependent on the wording and structure of the relevant DTA.

Where a secondment is contemplated, it is critical for all parties involved to

obtain professional advice regarding the interpretation and application of any

relevant DTA.

• The general rule applied in DTA’s based on the Organisation for Economic Co-

operation and Development’s Model Tax Convention (OECD MTC), is that

remuneration derived by a resident of a Contracting State (the home country) in

respect of employment, shall be taxable only in that State, unless the

employment is exercised in the other Contracting State (the host country). The

OECD MTC goes further to state that if the employment is exercised in the other

State (the host country), then that other State (the host country) may tax the

remuneration, but only so much that is derived therefrom. What this means,

potentially, is that both States (home and host country) will have the right to tax

the remuneration and no State has the sole taxing right. The aforementioned

problem generally occurs where the country in which the individual is resident

taxes income on a worldwide basis as opposed to a source basis of taxation in

the country where the services are actually rendered.

5